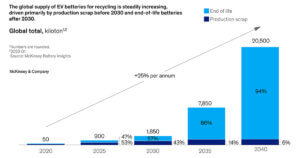

New supply chains to handle battery recycling are the subject of a recent report by the McKinsey group. With the growth of electric vehicles and the resulting growth in battery production new ways to provide more stable resilient and efficient recycling over fossil fuel internal combustion engines need to be developed.

The attached graph shows the forecast of how recycling will need to cater for the increased demand for recovery of essential metals and minerals from EV batteries.

Factors Driving EV battery recycling

McKinsey have nominated a range of levers that will fuel the battery-recycling industry:

- Technological progress as processes scale and mature is enabling higher recovery rates, lowering greenhouse-gas footprints, and improving economics. In addition, research and innovation project grants from governments are promoting recycling technology advancements such as the EU’s European Battery Alliance and United States National Science Foundation.

- Supply-Chain stablility considerations are being prioritized by various automotive OEMs and cell producers who are looking to secure local (recycled) raw material volumes at stable prices.

- Decarbonization and ethical supply-chain targets set by automotive OEMs lead to a preference for recycled battery materials over newly mined battery materials, given the former is characterized by about four times lower carbon emissions, resulting in a more than 25% lower carbon-emissions footprint per kilowatt-hour (kWh) of battery cell capacity produced. Furthermore, sourcing from recyclers domestically avoids creating primary demand for raw materials sourced from conflict regions or extracted using child labour, or both.

- Regulatory incentives are creating conducive conditions for local recycling, such as the US Inflation Act 2022 that allows recycled battery materials (for example, lithium, cobalt, and nickel) to qualify for significant tax credits available through the domestic materials clause, even if those materials were not originally mined in the US or in countries with which the US has free trade agreements. (The Australian government is believed to be considering a range of incentives for the future as part of their transition strategy)

- Regulatory pressure is further encouraging organizations to recycle. The EU for example, has instituted its End-of-Life Vehicles Directive that mandates automotive OEMs to take back vehicle owners’ end-of-life batteries. The TU’s Fit for 55 package has further promoted OEM interest in recycling by requiring the publication of battery carbon footprints, as well as by setting collection and recycling targets including minimum recycled content requirements for newly built batteries. In the US there is a similar legislative trend.

Ecobatt have made a significant investment in the safe handling and recycling of electric car batteries and this will be enhanced in the years ahead as it seeks to increase its capacity and capabilities to recycle EV batteries in line with the growth in the market.